Home » G7 finance summit convenes: corporate tax avoidance in the crosshairs

G7 finance summit convenes: corporate tax avoidance in the crosshairs

Italy is determined to corral its G7 partners into taking ‘concrete steps’ to tax internet-based companies at the group’s finance summit on Thursday.

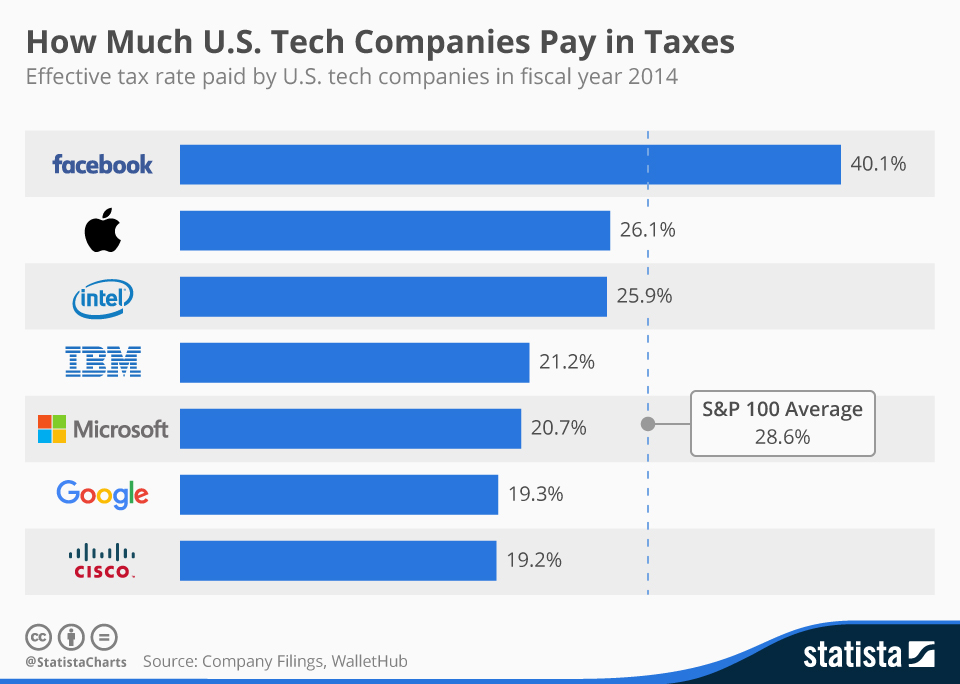

By shifting money across borders, companies are estimated to dodge an eye-watering $240 billion of taxes each year. Now governments are looking to cash in, working together to close loopholes and mandate transparency. However, the legal quagmire presented by cyberspace has led to several disagreements within the G7 on how to target this elusive tax revenue.

Two distinct approaches have emerged. The first is the Italian model, which seeks to settle tax bills via negotiated deals. Rome recently secured $335 million of back taxes from Google using this method and now has Amazon and Apple in its crosshairs.

But other G7 members reject this more amicable approach, preferring instead to take corporations to court. France, for instance, has raided Google’s Paris offices in pursuit of almost $1.2 billion of unpaid taxes.

G7 members probably won’t agree on a unified plan of attack—indeed a hybrid approach is probably the most practical. Nonetheless, it appears the tech industry’s free ride may be coming to an end.